What is Managed Account ?

- FINANCE

- quality

- Trust

For investors who are ready to take significant risks, wish to have experts handle trading and selection, and want to benefit from the possible rewards of leveraged forex trading, managed forex accounts provide an option. The process involves depositing funds into a foreign exchange account and having a professional trade those funds in the foreign exchange markets.

A managed forex account is one in which a qualified forex trader (money manager) oversees trading on behalf of clients in exchange for a performance fee. Each investor at a brokerage business owns a managed forex account, which is a completely separate account. The money manager of these forex trading accounts, also known as sub or slave accounts, trades from a master account at the same brokerage house.

KEY TAKEAWAYS

RISK AND REWARD

This investment is High Risk High Reward

MINIMUM DEPOSIT

PAMM ULTRA offer managed account services with a deposit as low as $100

UNDERSTANDING MANAGED ACCOUNT FOREX

Usually, individual speculators create forex accounts and try to trade using their own knowledge and conjecture. While the few that are successful can generate extraordinary profits that are multiples of normal stock markets, many find this to be very challenging. Using the services of a professional manager is a way to attempt skipping the extra time and eventual loss that comes to inexperienced traders in this market, and hoping that a more seasoned professional can be trusted to deliver the hoped-for returns.

Unlike stocks or bonds, managed FX accounts provide exposure to a quite different asset class. Forex transactions increase in value when the value of one currency rises or falls in respect to another, in contrast to these stocks, which provide returns in the form of dividends, interest payments, or share growth.

A managed Forex account could be a good option for people who are not very knowledgeable about foreign exchange but yet wish to be exposed to the market and another asset class. They may benefit from the experience and track record of a seasoned and successful Forex trader by using a managed account. The drawback of this strategy is that top managers usually demand high-performance fees that range from 20% to 30% of a trade’s profits.

A Limited Power of Attorney agreement (LPOA), which is given by the brokerage firm, must be signed by the client investor and the money manager (a qualified forex trader). This contract serves as an agreement between the customer (investor) and the professional trader (money management), allowing the trader to trade on the investor’s account on their behalf. The management and the investor are unable to move money to one another’s trading accounts. For the investor, the LPOA document offers a high degree of protection, control, and transparency. As previously said, the investor has complete control over their account once they sign the LPOA, which places the managed (sub account) account in the Multi Account Management (MAM) system. If an investor is dissatisfied with the management service, they can cancel the LPOA agreement at any moment, check the balance, deposit and withdraw money, and keep an eye on trading activities. Using PAMM or MAM software, a money manager may trade for several investors from a single master account. The majority of respectable brokerages use these technological processes, enabling experienced forex traders to oversee investor accounts.

Your Profit our Priority

How PAMM Ultra works

- FINANCE

- quality

- Trust

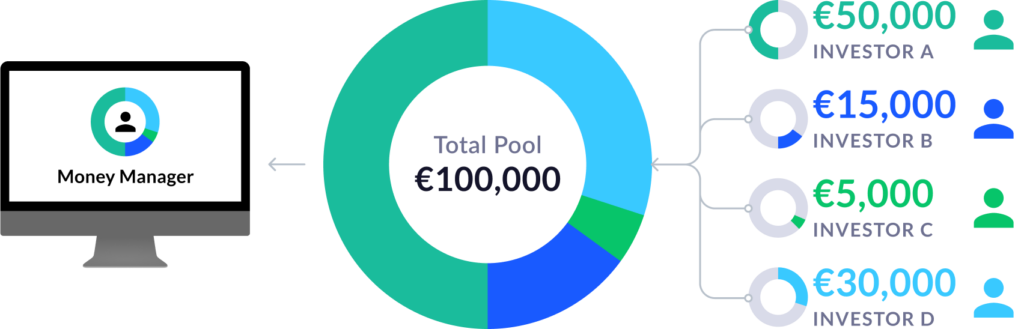

If a PAMM / MAM account has 3 clients with various deposits as follow, which in total the amount is US$ 100,000.

Investor A – US$ 15,000 (15%)

Investor B – US$ 50,000 (50%)

Investor C – US$ 35,000 (35%)

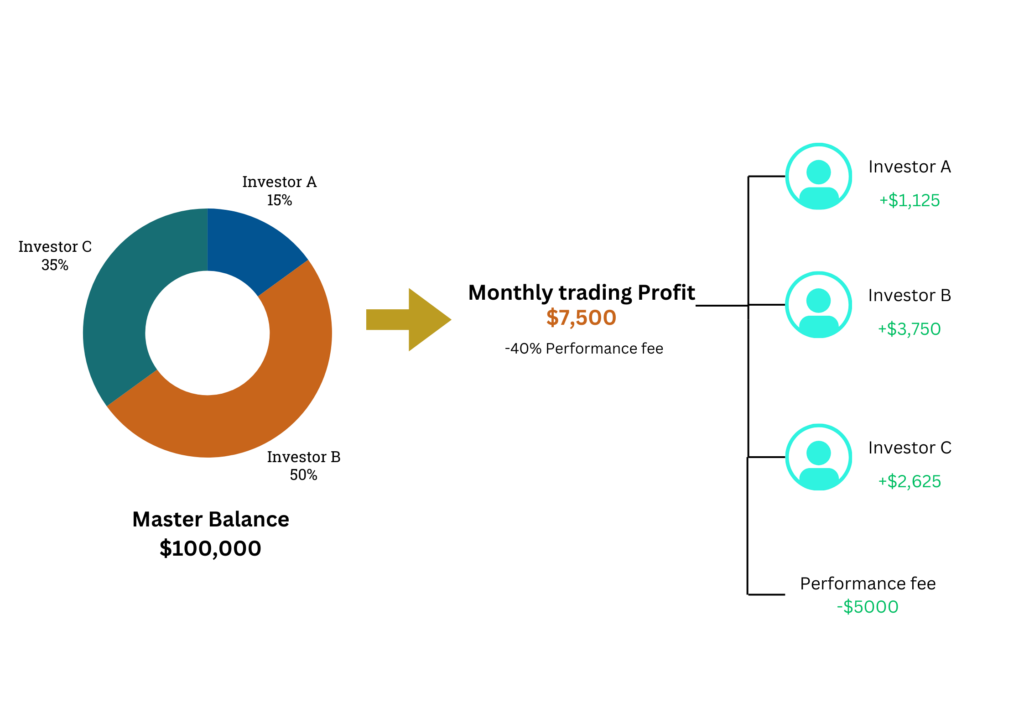

If the portfolio managers generate profits of US$ 12,500 in the PAMM / MAM account, the profits will be divided among the investors according to the percentage above. PAMM Ultra portfolio managers charge performance fee of 40% of the total profits of US$ 12,500. The portfolio managers shall be entitled for US$ 5,000 and the balance of US$ 7,500 shall be divided among the investors.

Investor A – US$ 1,125 profit (15% of US$ 7,500)

Investor B – US$ 3,750 profit (50% ofUS$ 7,500)

Investor C – US$ 2,625 profit (35% ofUS$ 7,500)

The following chart shows the profit and loss allocated proportionally to the participating investors and performance fee to portfolio managers in the PAMM / MAM account.

Why invest in Managed Forex Accounts with PAMM ULTRA ?

- A professional trader (money manager) oversees the invested funds of clients without having access to the capital itself.

- No technical expertise or experience of currency trading is required of investors.

- Investor can choose among leading investment strategies

- Only at the conclusion of a profitable month, subject to a high watermark basis, is a performance fee assessed.

- Low minimum investment.

- Low minimumTotal control over trading account. Investor can deposit, withdraw or cancel management service at any time. investment.

- Clients have information on the balance of their accounts 24 hours a day, 7 days a week.