PORTFOLIO MANAGERS PERFORMANCE

- FINANCE

- quality

- Trust

At PAMM ULTRA, we place a strong focus on individual responsibility. Since we think that our traders should handle our customers’ money with the highest care, we demand that they invest their own money alongside our clients’. You may thus count on diligence and a strong dedication to increasing your returns over time, regardless of the portfolio manager or managers you have selected.

TOP PERFORMING PORTFOLIO MANAGERS

We currently offer 11 portfolio managers that clients can choose from, PrimeFactor, Inspecto, Semi-HFT, Newsflash, Berkeley, Victorious, Elitist, Serenity, Cloud Trader, Fortuna and Global Vision. They employ a mix of both algorithm and manual trading methods as part of profit-making strategy.

Our portfolio managers provide investors with access to money markets, emphasising G10 currencies, commodities and indices. We aim for a total annualised return in excess of the benchmark over any 3-year rolling period, while preserving capital with a maximum drawdown of 20 – 40% of the capital (non guaranteed).

At PAMM ULTRAl be regularly updated on your investment progress. Statements detailing trades placed on your account will be emailed to you daily and monthly. Each portfolio manager has verified track records with Myfxbook from regulated brokers.

The percentages shown may change according on the executions, liquidity, price, technological constraints, and other factors of various brokerages. To represent real performance statistics, VESBOLT uses the nearest average percentage of many linked brokerage firms based on our best effort. As a result, we always stress how crucial it is to diversify your money among several brokerage firms.

KEY TAKEAWAYS

RISK AND REWARD

This investment is High Risk High Reward

MINIMUM DEPOSIT

PAMM ULTRA offer managed account services with a deposit as low as $100.

We combine our personal capital with yours

SEMI-HFT

Developed by a group of successful records traders from Eastern Europe, Semi-HFT is a super scalping trading system that incorporates High Frequency Trading (HFT) technology. It is an automated trading method that applies mean reversion to a number of foreign exchange pairings. In essence, mean reversion indicates that the price would return to its mean. The technique exclusively trades during the Asian session, when the market is quiet, for maximum efficiency.

Semi-HFT is a system with dynamic stop loss management that greatly improves algorithm stability by combining dynamic and hard stop loss. A stop-loss order protects every trade. The algorithm is supervised by human fund managers.

Performance Fee: 40%

Available on: Europe region

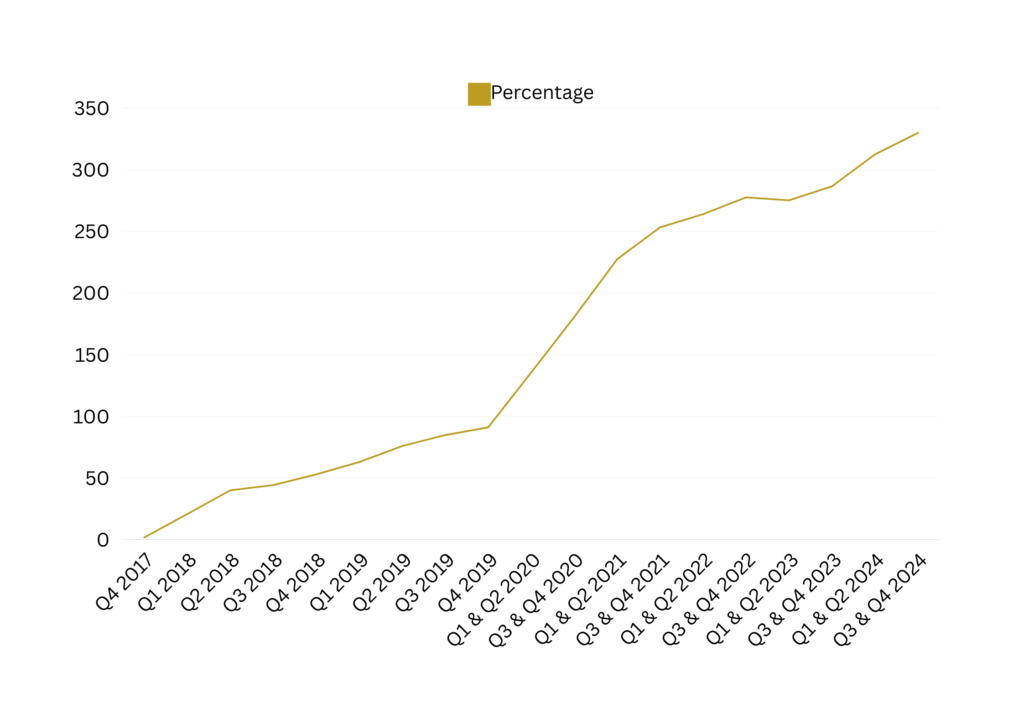

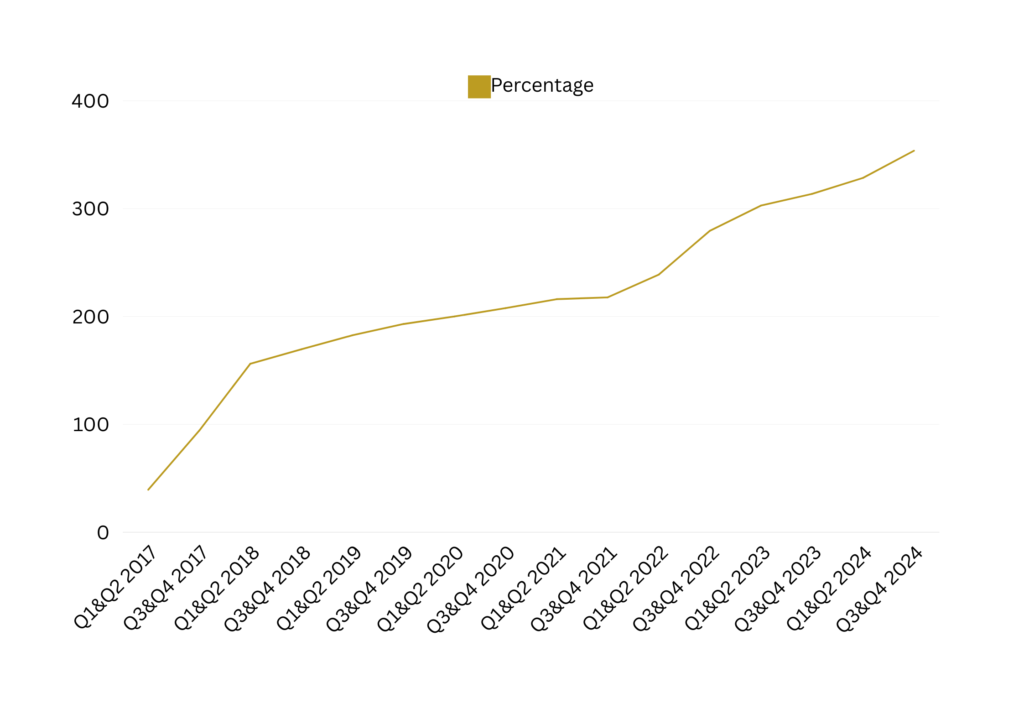

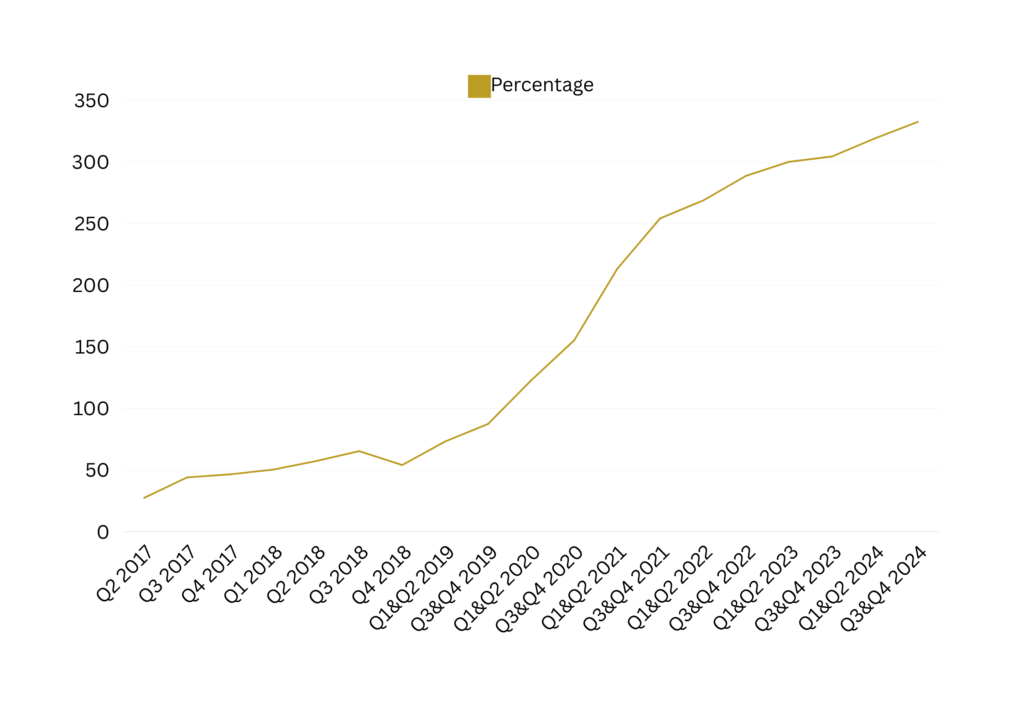

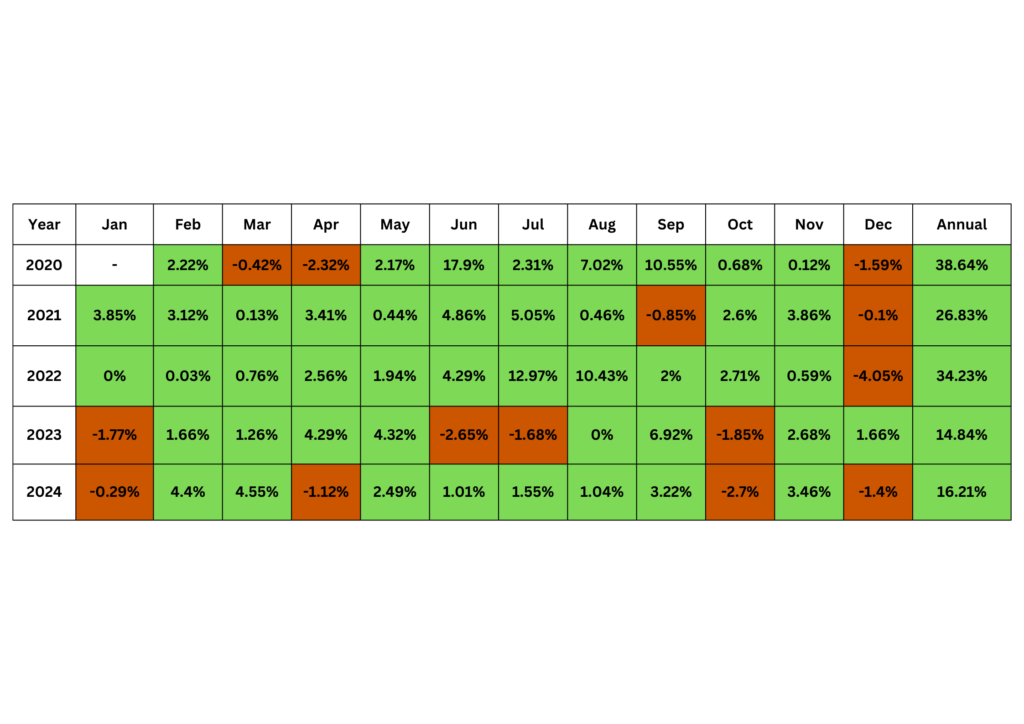

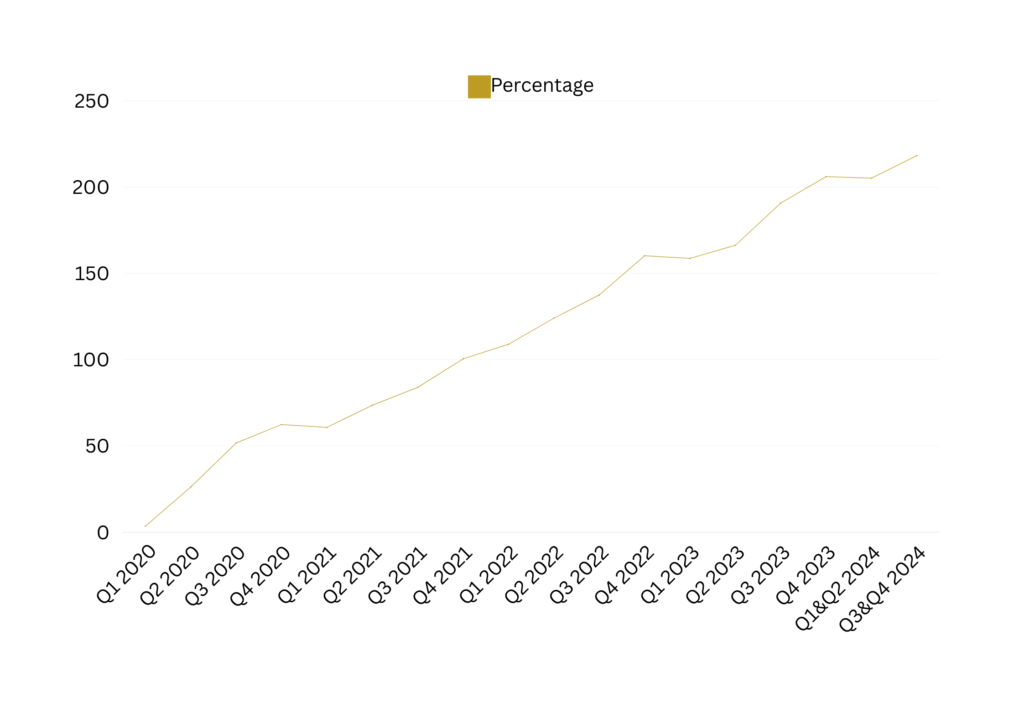

SEMI-HFT PERFORMANCE CHART

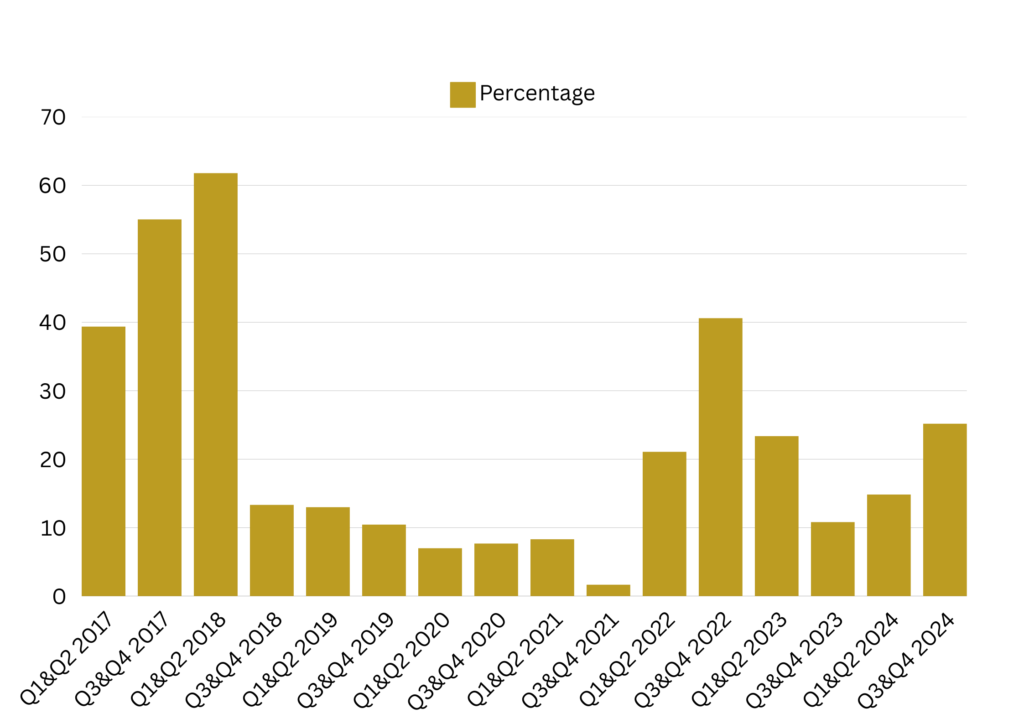

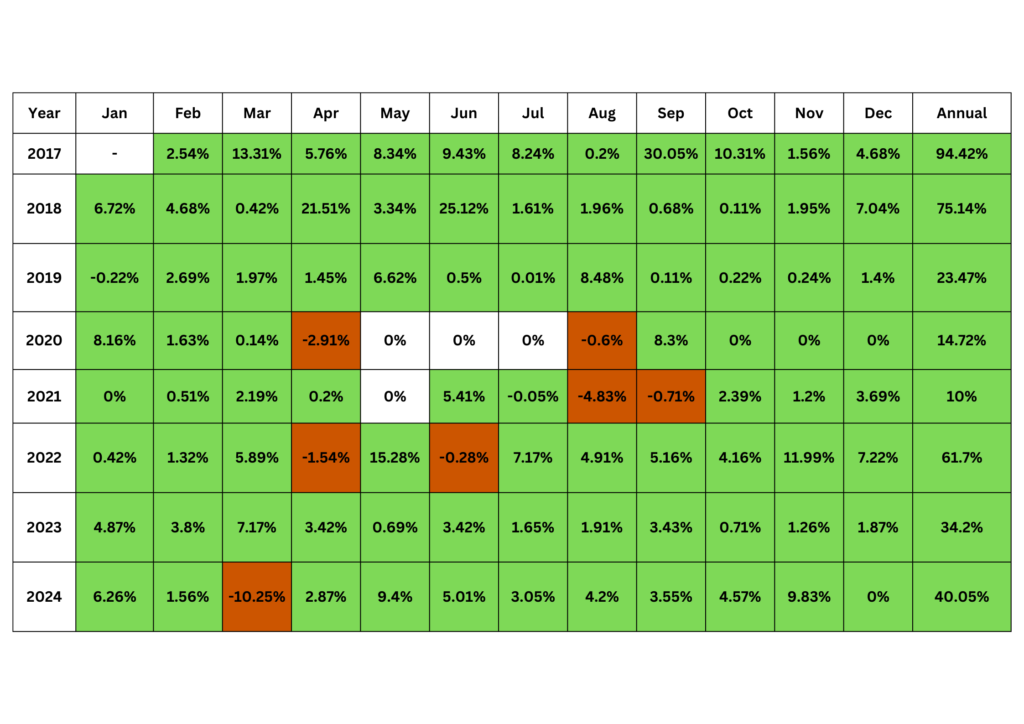

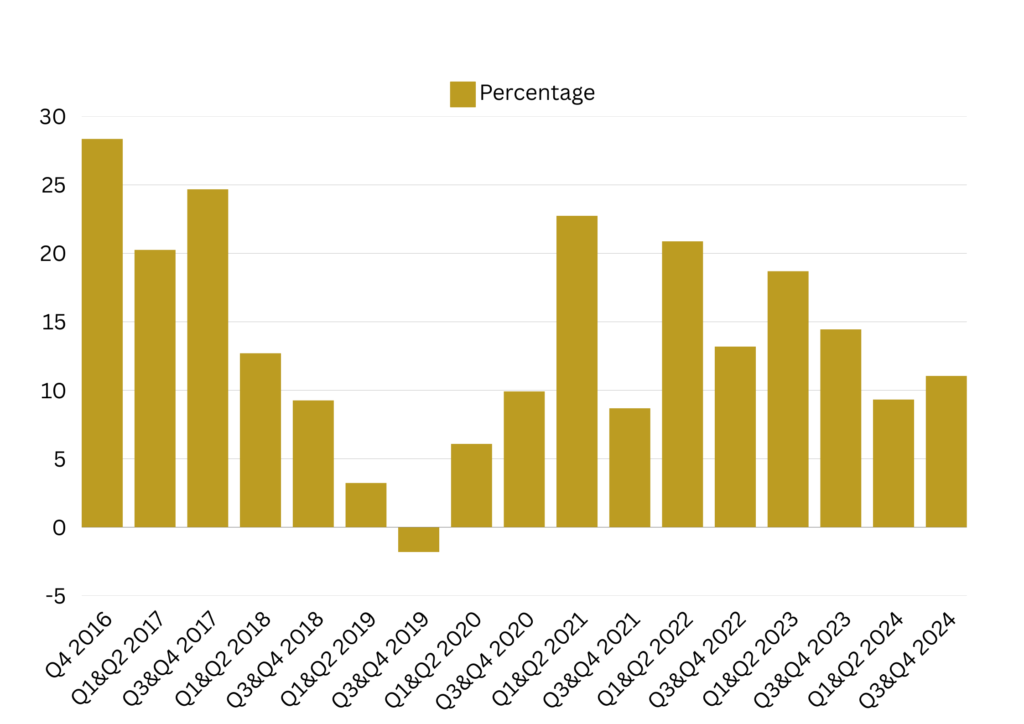

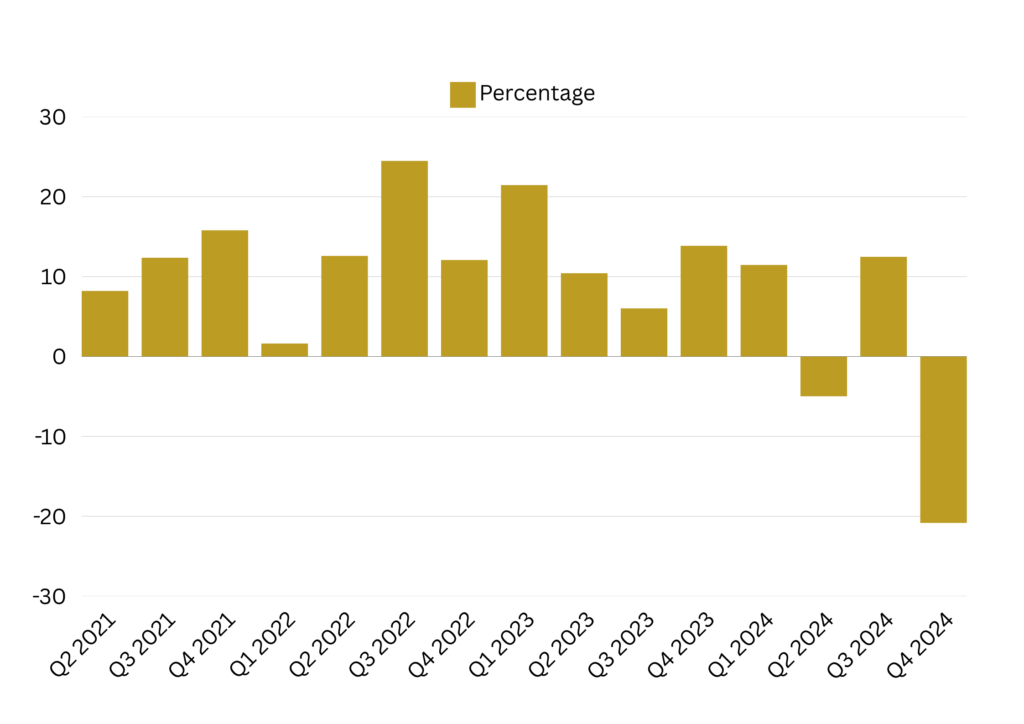

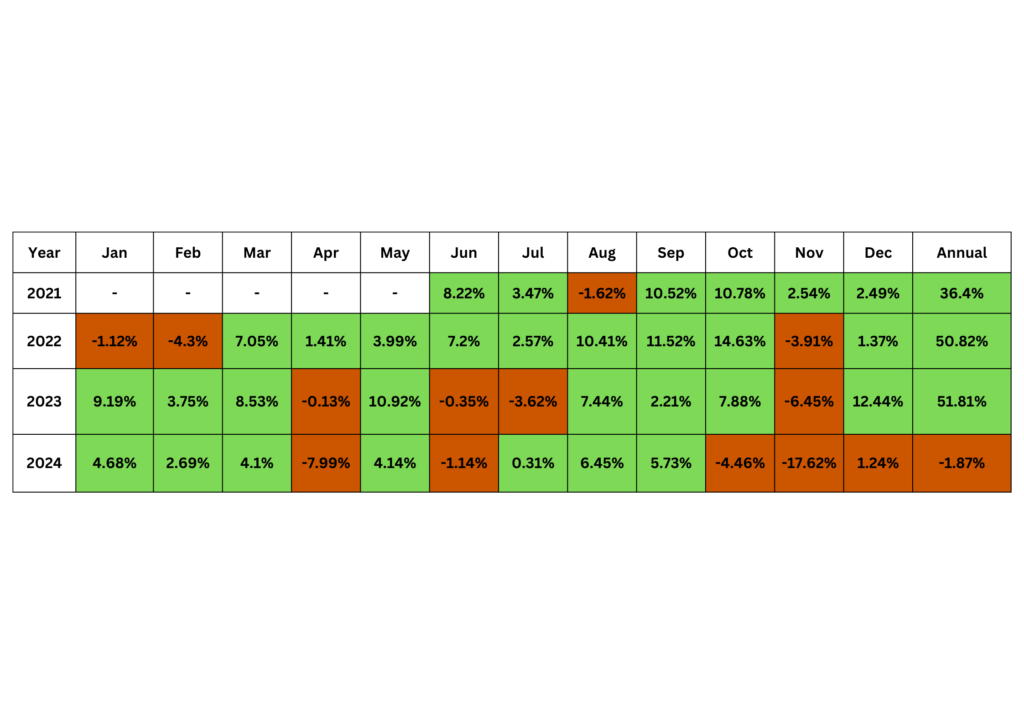

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

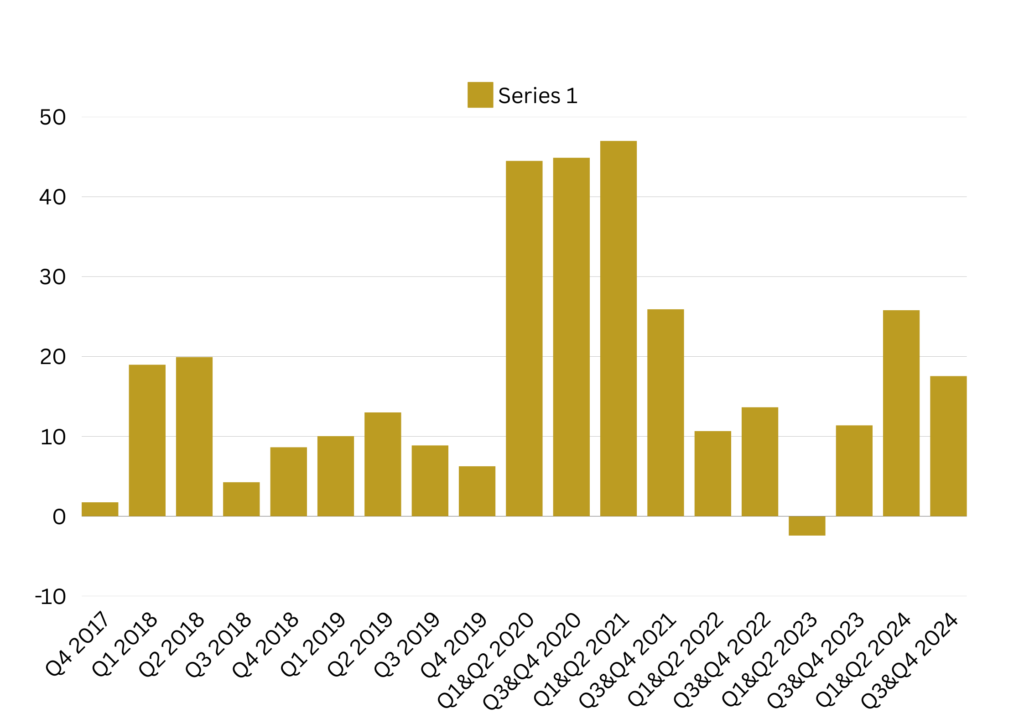

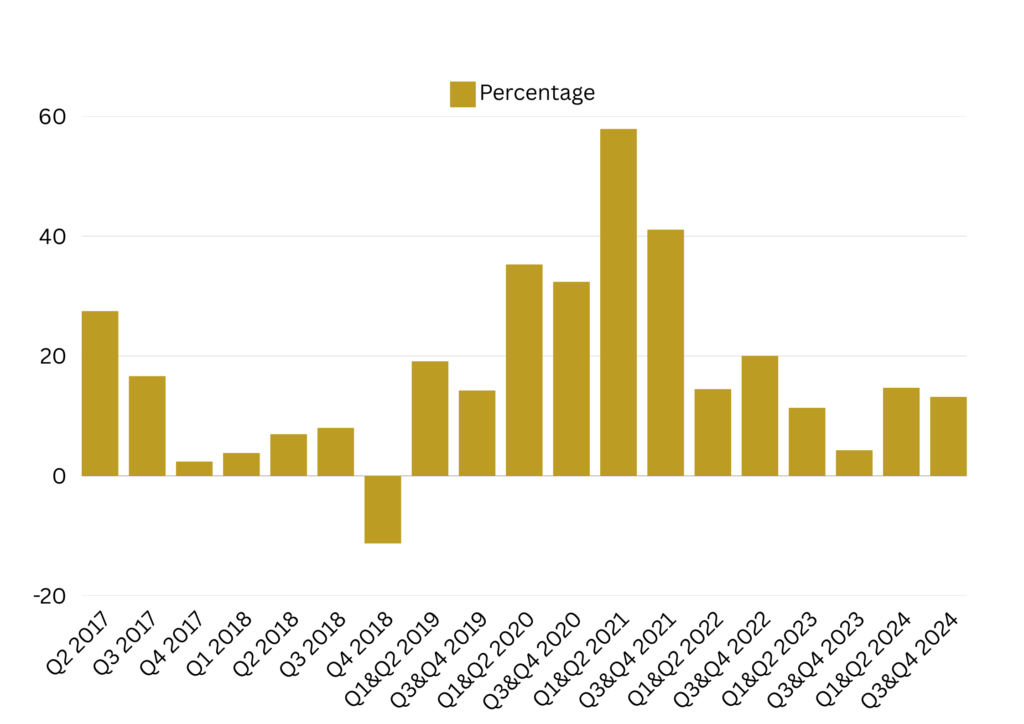

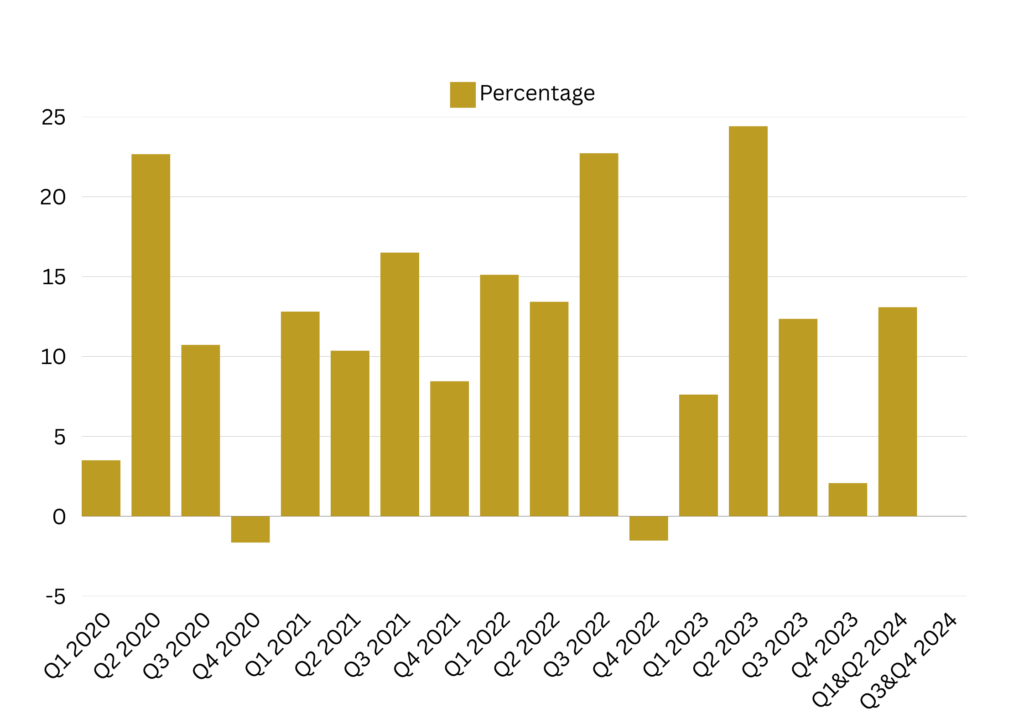

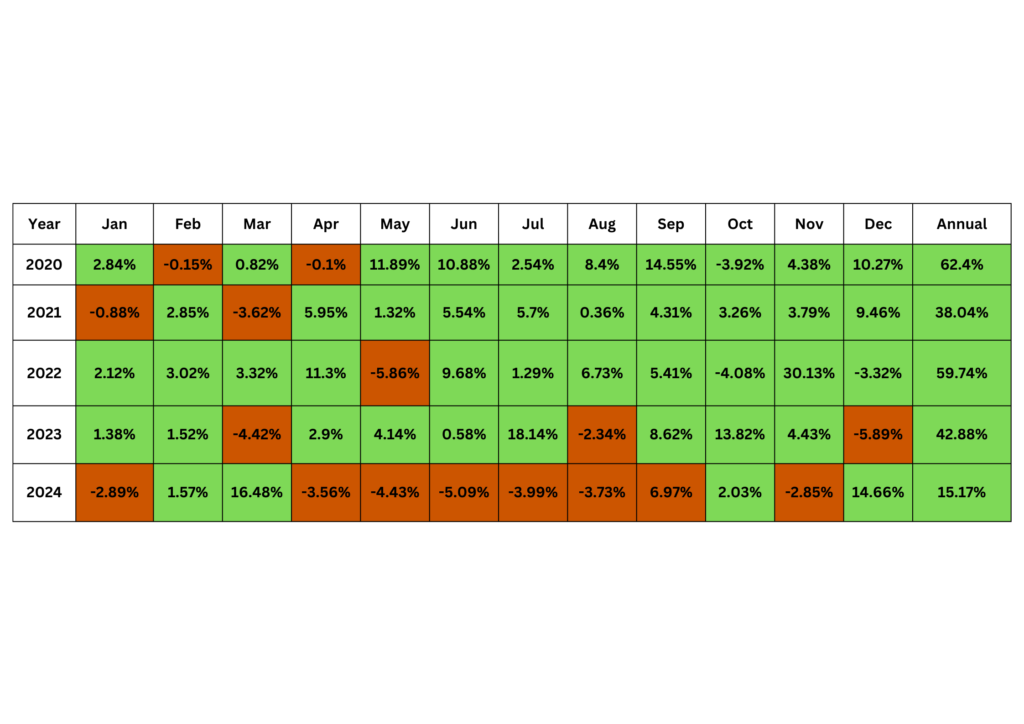

SEMI-HFT QUARTERLY ANALYTICS

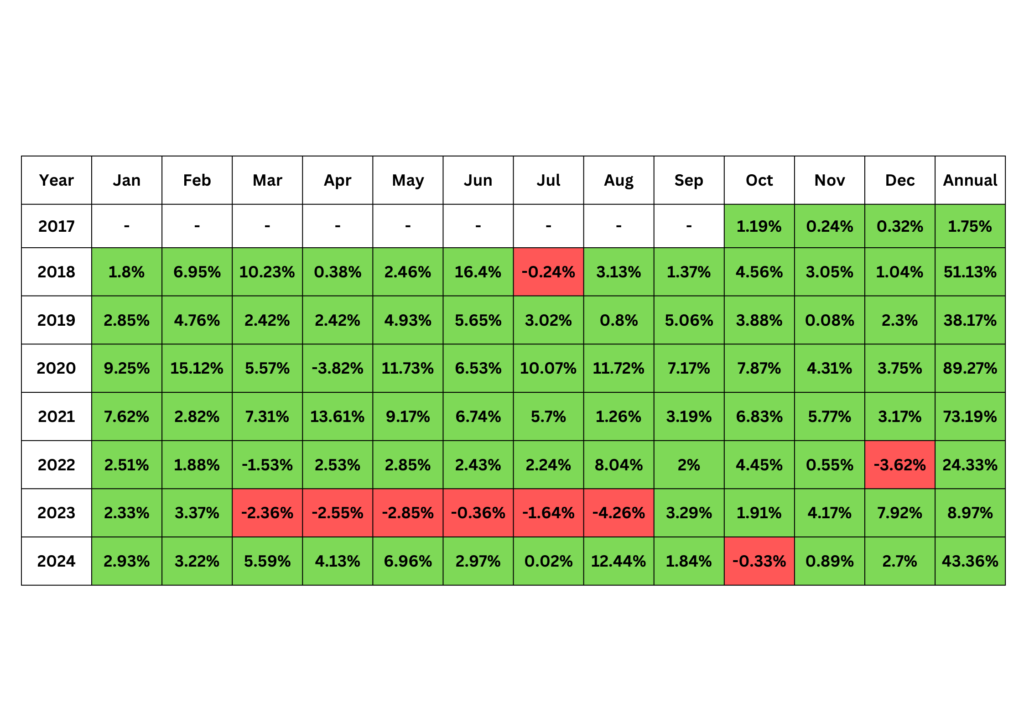

SEMI-HFT MONTHLY RETURNS%

Your Profit our Priority

INSPECTO

Inspecto is a sophisticated expert advisor system that focuses on steady G10 currency pairings and gives priority to night scalping trading. It is created and run by a group of Russian proprietary traders. With an average holding length of just three hours, the technique is predicated on short-term scalping around rollover times. A correction of the day’s movement usually occurs around the end of a trading day. Important economic and political news that might have a big impact on prices is taken into consideration.

To maximize the risk-return ratio, the Inspecto team has demonstrated success in technical analysis and money management system development. Every order has a predetermined stop loss and take profit. Because of the significantly higher spreads, a virtual stop loss is imposed at rollover time.

Performance Fee: 40%

Available on: EU Region

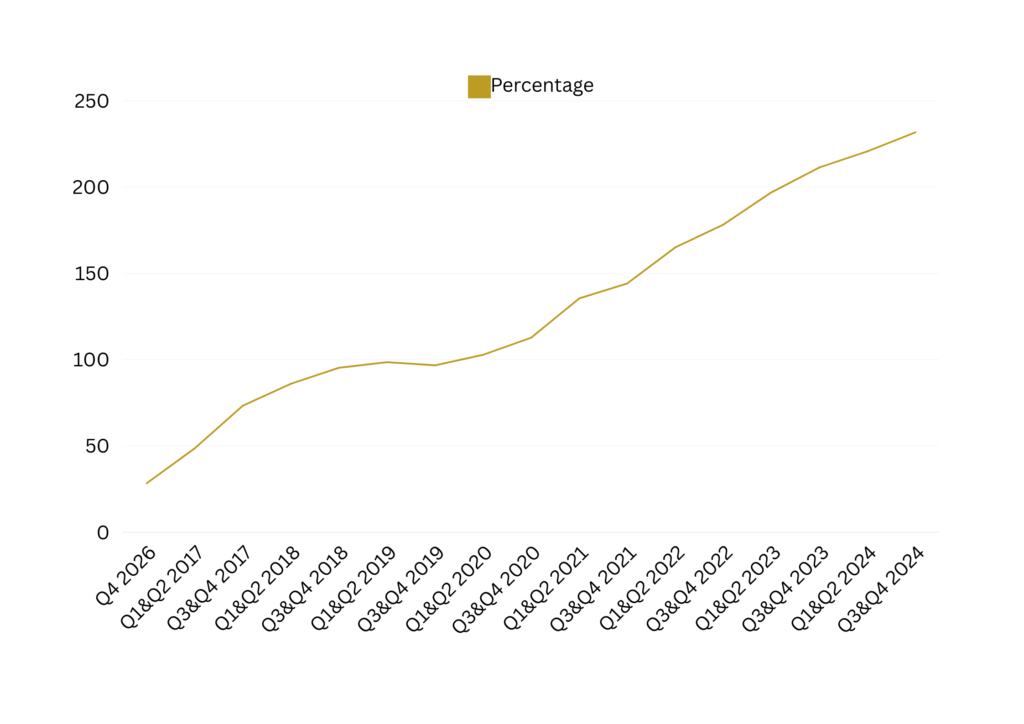

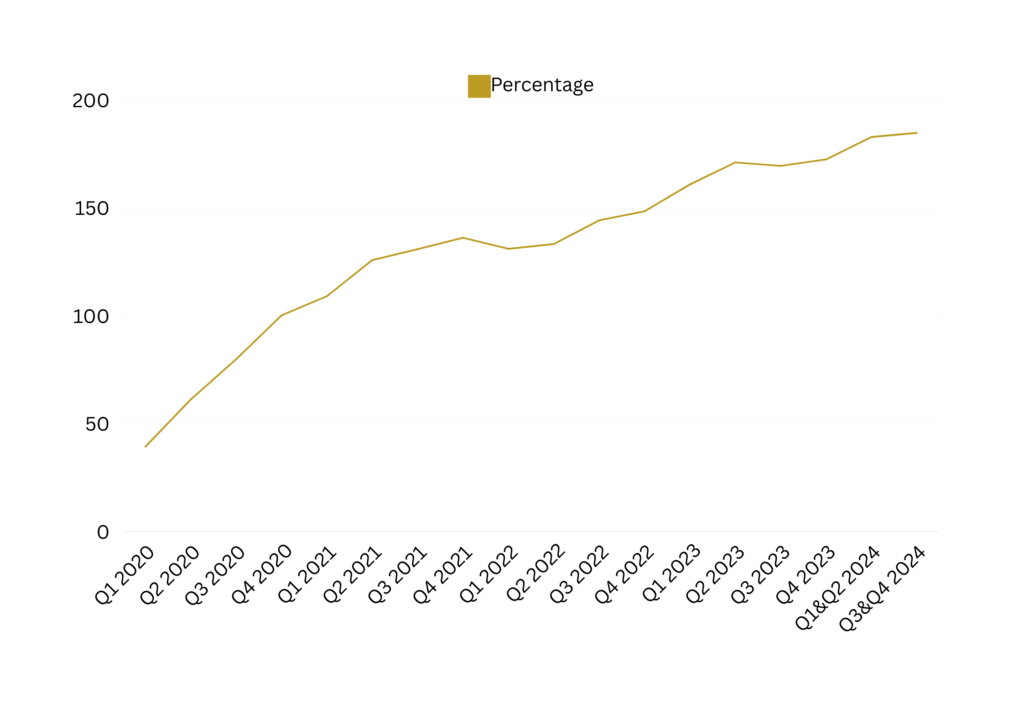

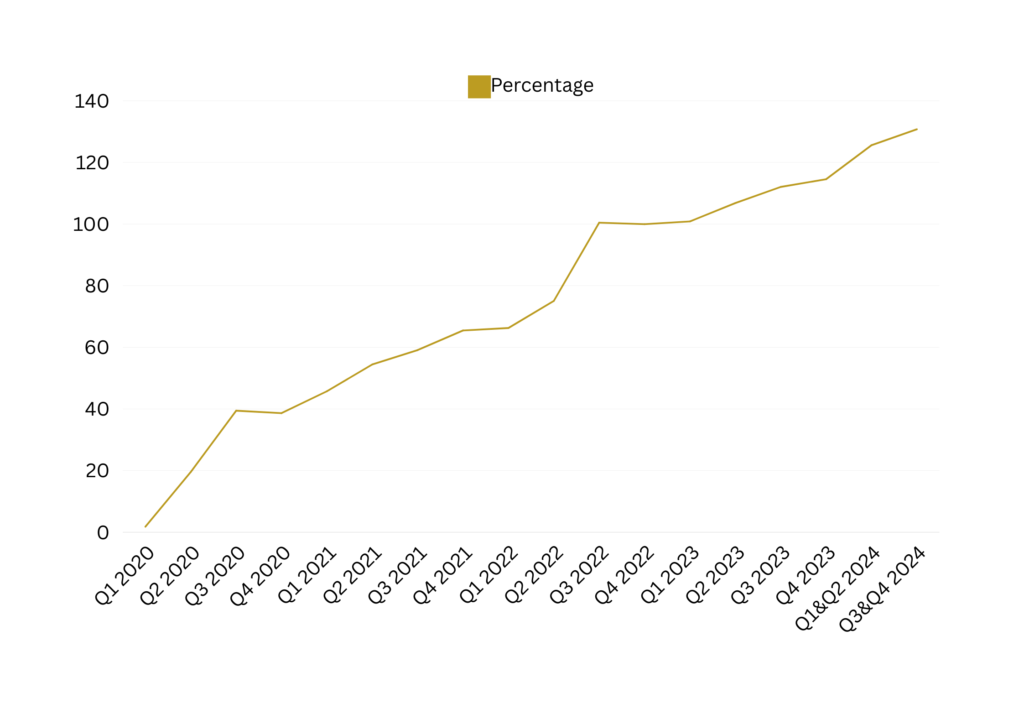

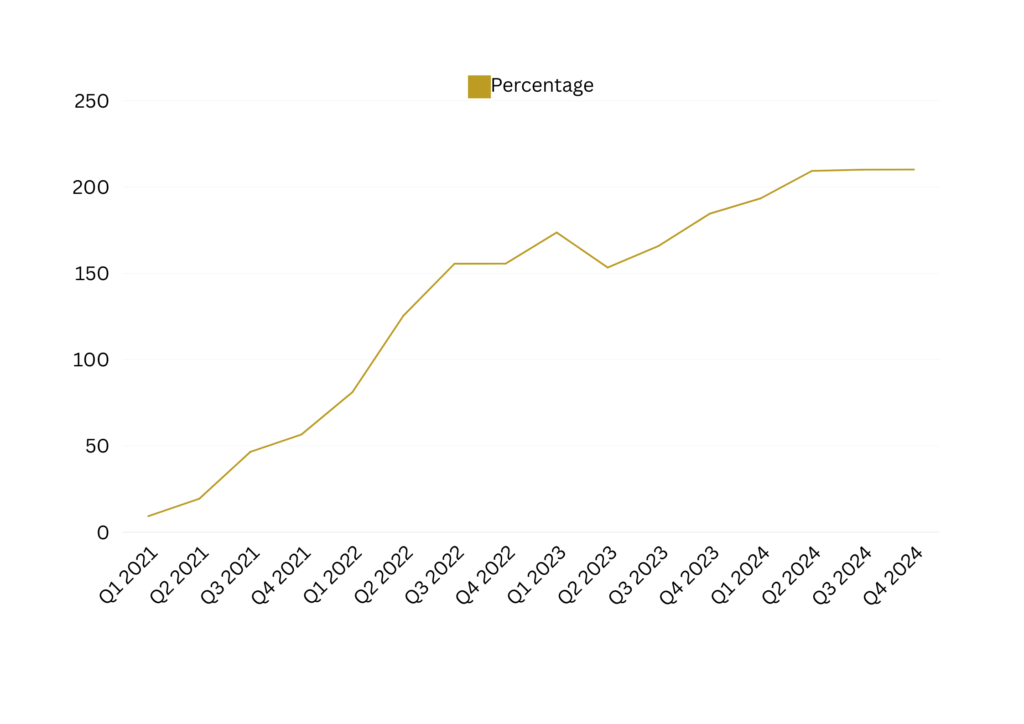

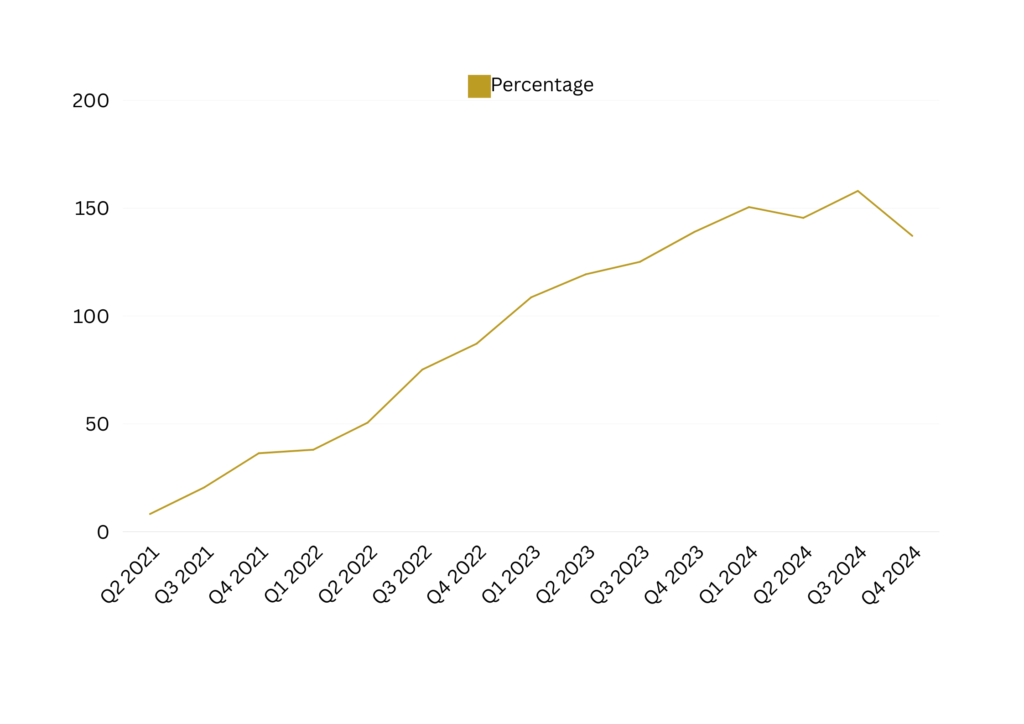

INSPECTO PERFORMANCE CHART

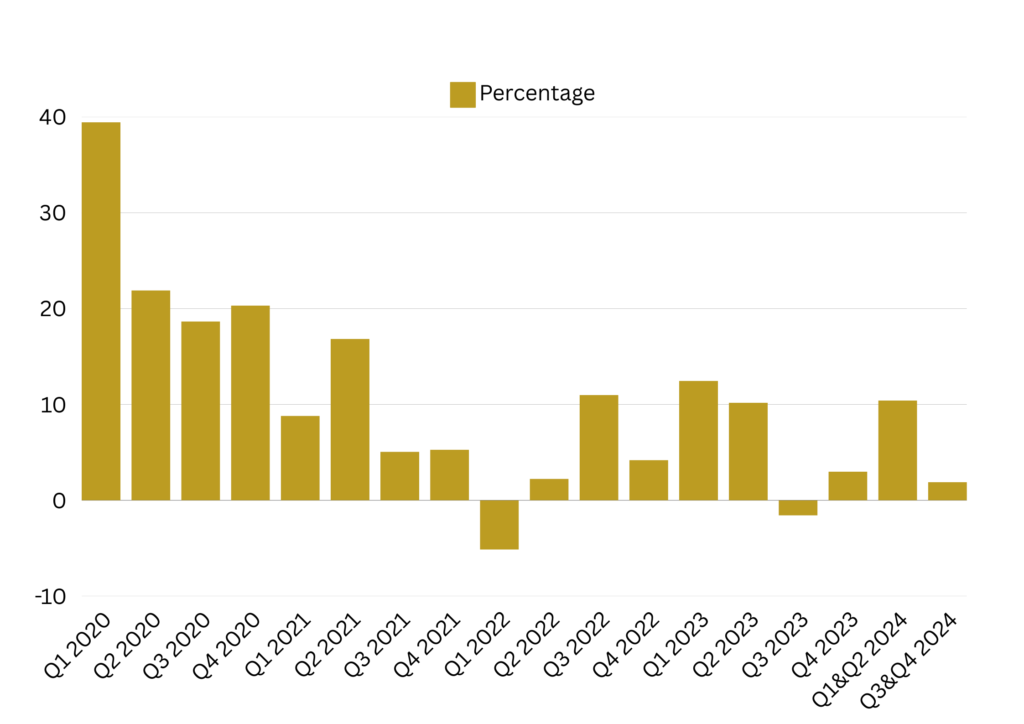

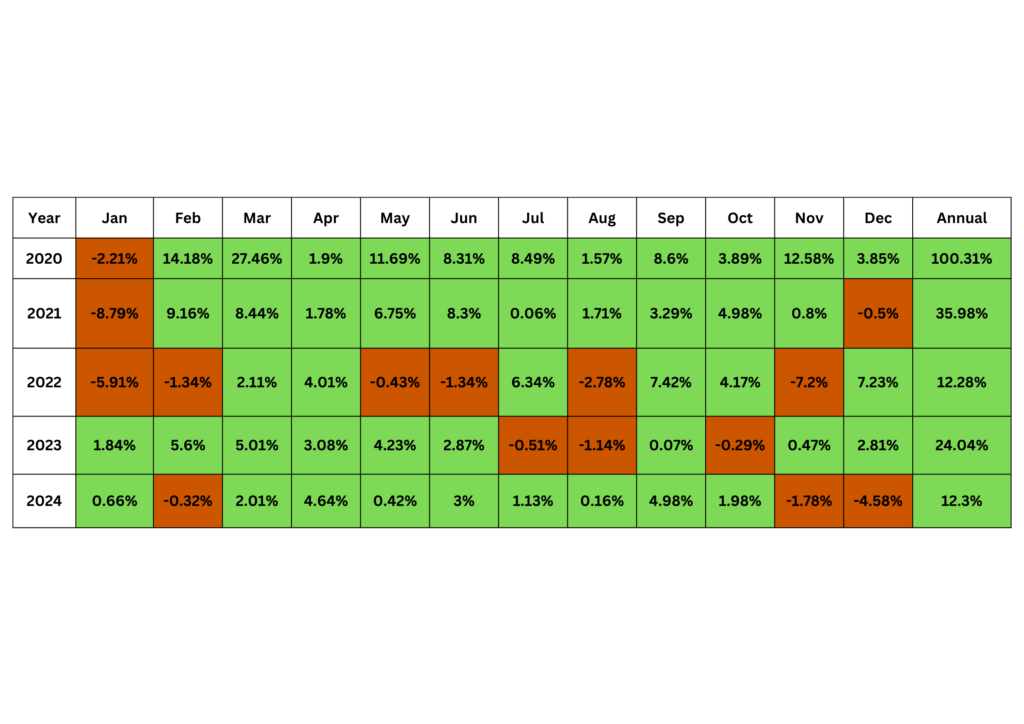

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

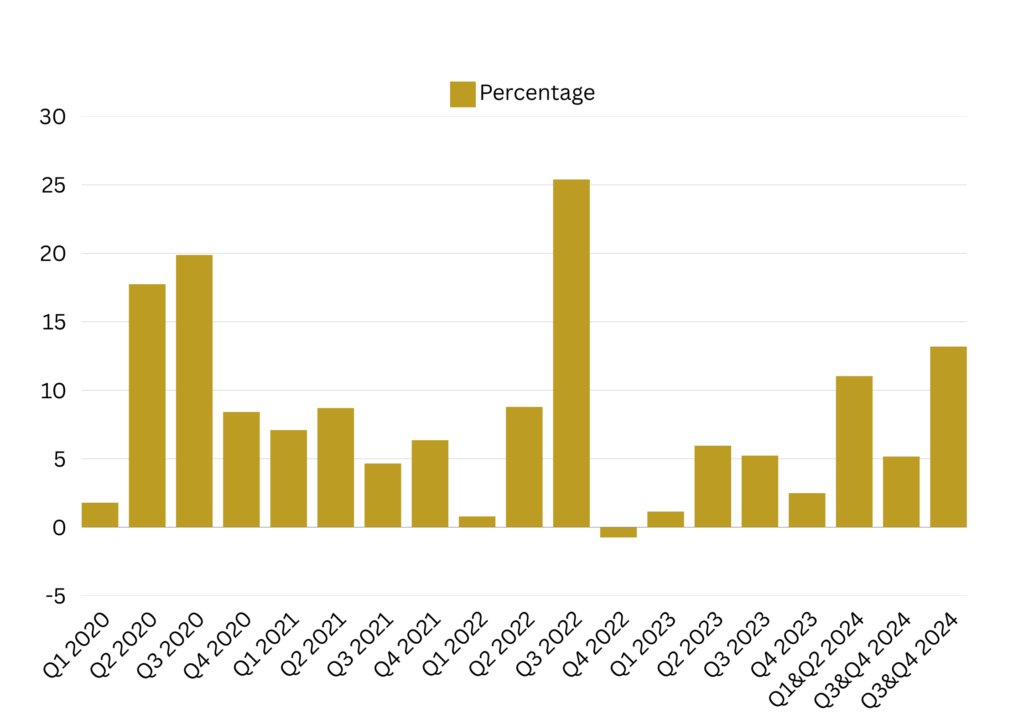

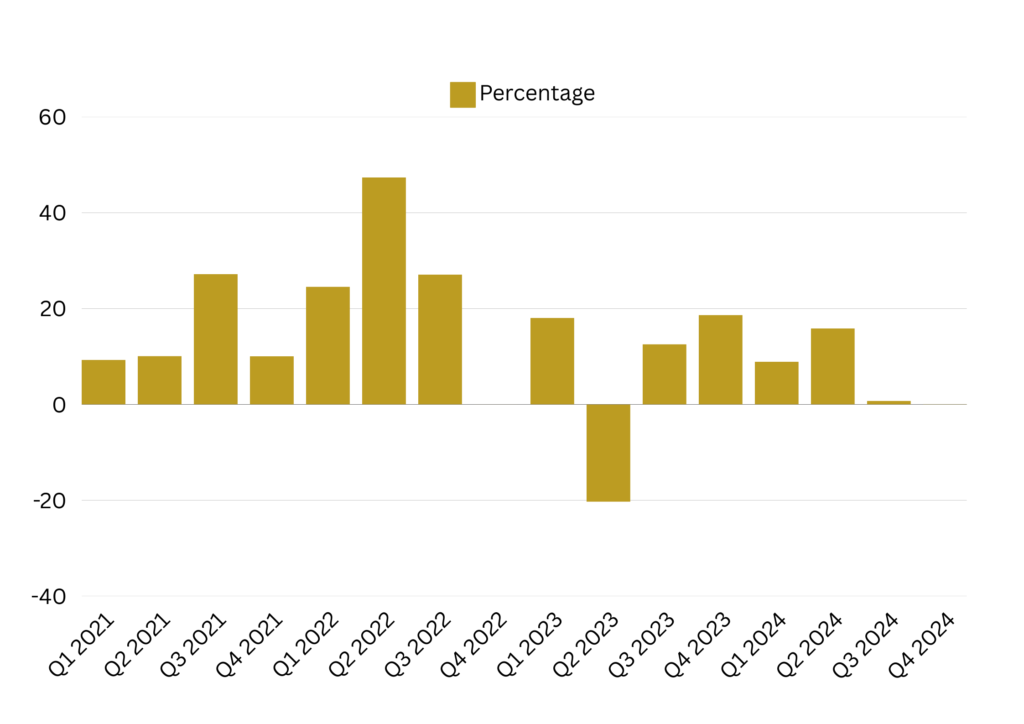

INSPECTO QUARTERLY ANALYTICS

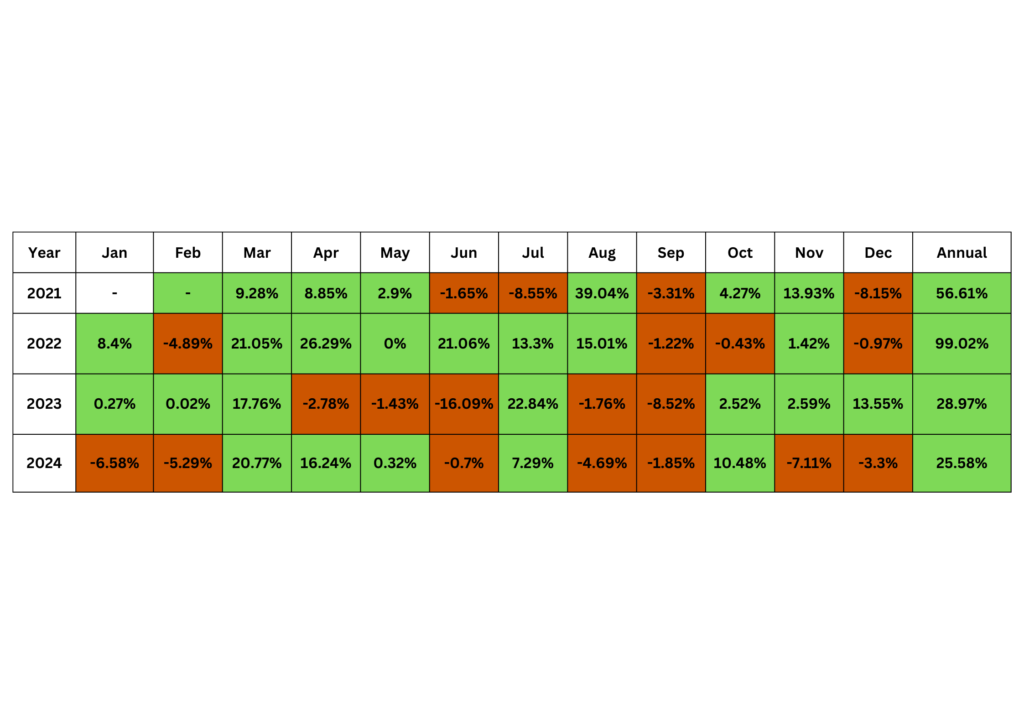

INSPECTO MONTHLY RETURNS%

Your Profit our Priority

PRIMEFACTOR

A group of HFT specialists located in London, UK, created PrimeFactor, a high-speed algorithmic trading system with integrated unique dynamic portfolio management. This strategy uses a complex algorithm with a greater mean reversal ratio and has a significant deal of diversity in its operations over 20 currency pairings and gold. This strategy has been shown to lower exposure to a single pair or individual operations while increasing the likelihood of sustainable development. It uses a patented algorithm for dynamic portfolio balancing, which modifies each pair’s weight and responsibility. There is a daily volatility management system in place to lessen risk exposure during erratic market conditions.

The system’s ability to realistically handle internal modifications shows how strong the algorithms are and supports the likelihood of continuing to perform well in subsequent moves. With almost three years of active trading since 2019, it demonstrates exceptional flexibility in responding to any kind of market structure behavior, whether it is trending or sideways.

Performance Fee: 40%

Available on: EU Region

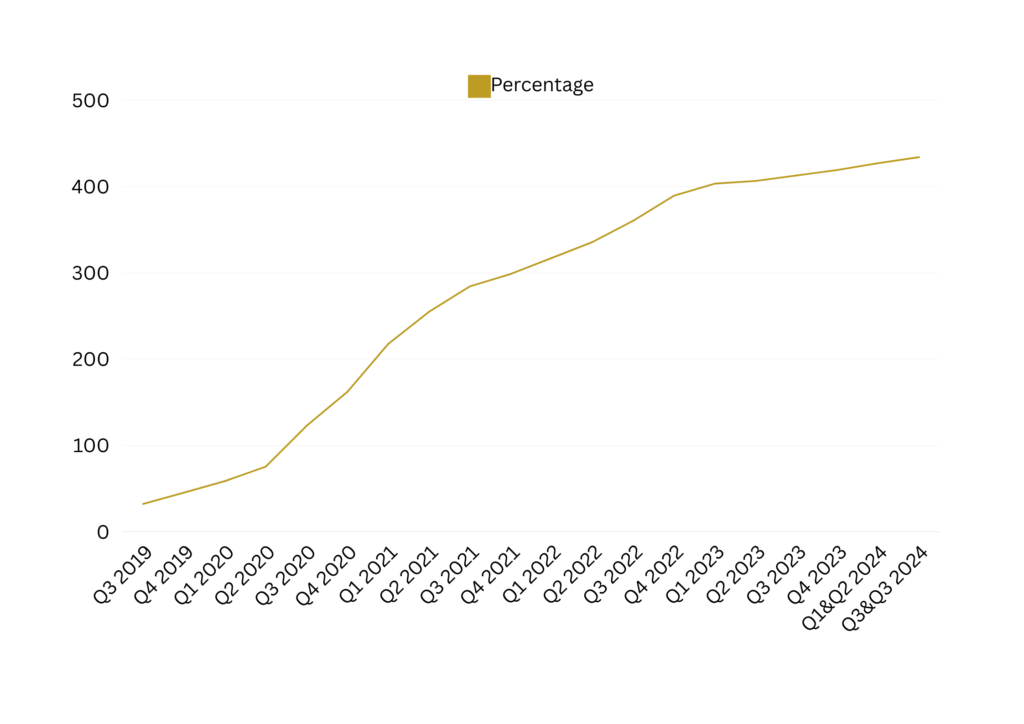

PRIMEFACTOR PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

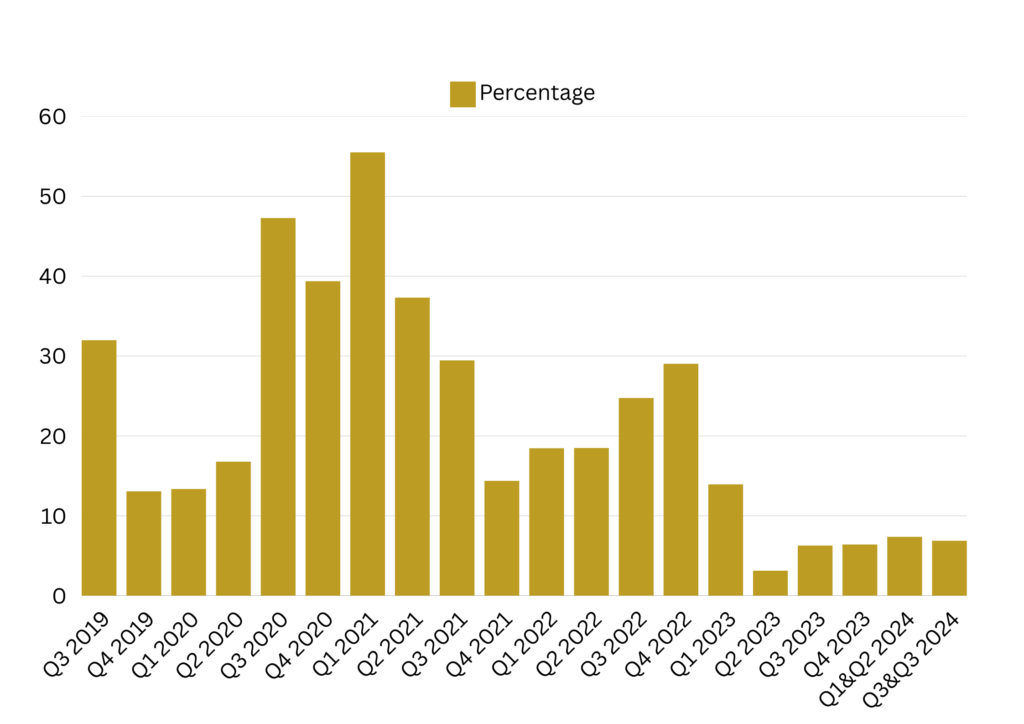

PRIMEFACTOR QUARTERLY ANALYTICS

PRIMEFACTOR MONTHLY RETURNS%

Your Profit our Priority

NEWFLASH

An institutional or bank-grade API news trading system, Newsflash trades a variety of asset classes, such as indices, commodities, and currencies. The proprietary platform used for trading was created by a skilled, UK-based proprietary trading team. Over the course of the previous 15+ years, several components have been custom-built, costing about $1 million to produce. Scalping for big profits on news trading is Newsflash’s primary tactic, and holdings are often held for a short period of time.

The team trades directly on accounts using sophisticated trading strategies that are often unavailable to regular traders. They also employ an automated system to boost speed. This API trading technique has a very high probability, low latency, and minimal drawdowns. Recovering the money from market makers who have benefited from conventional retail systems is the aim.

Performance Fee: 40%

Status: United kingdom, France, Cyprus

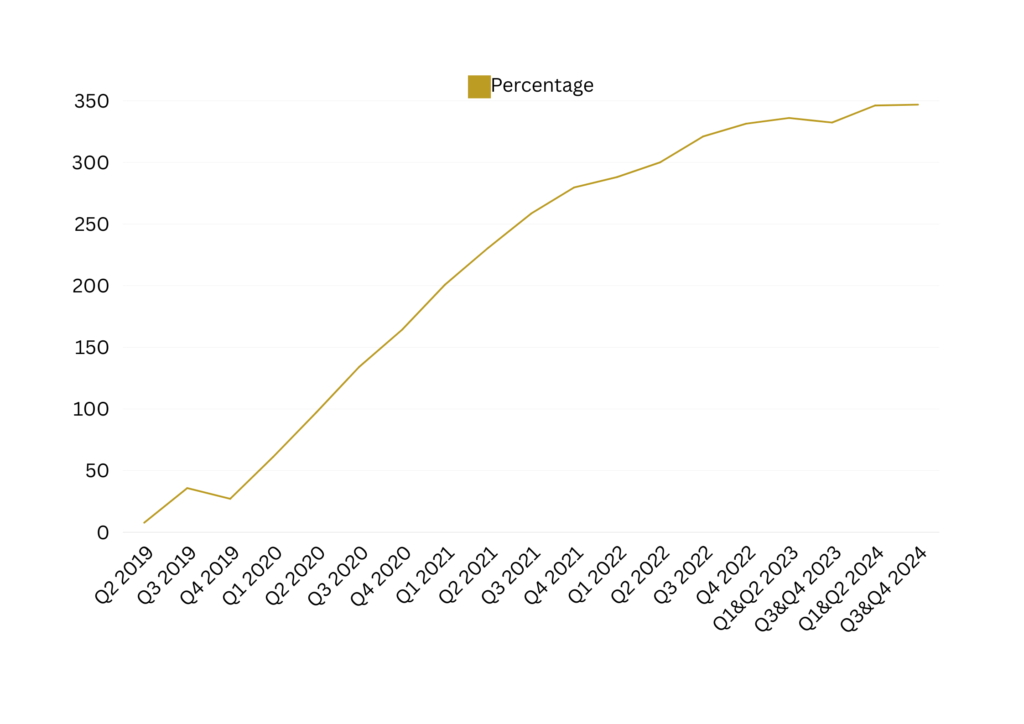

NEWFLASH PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

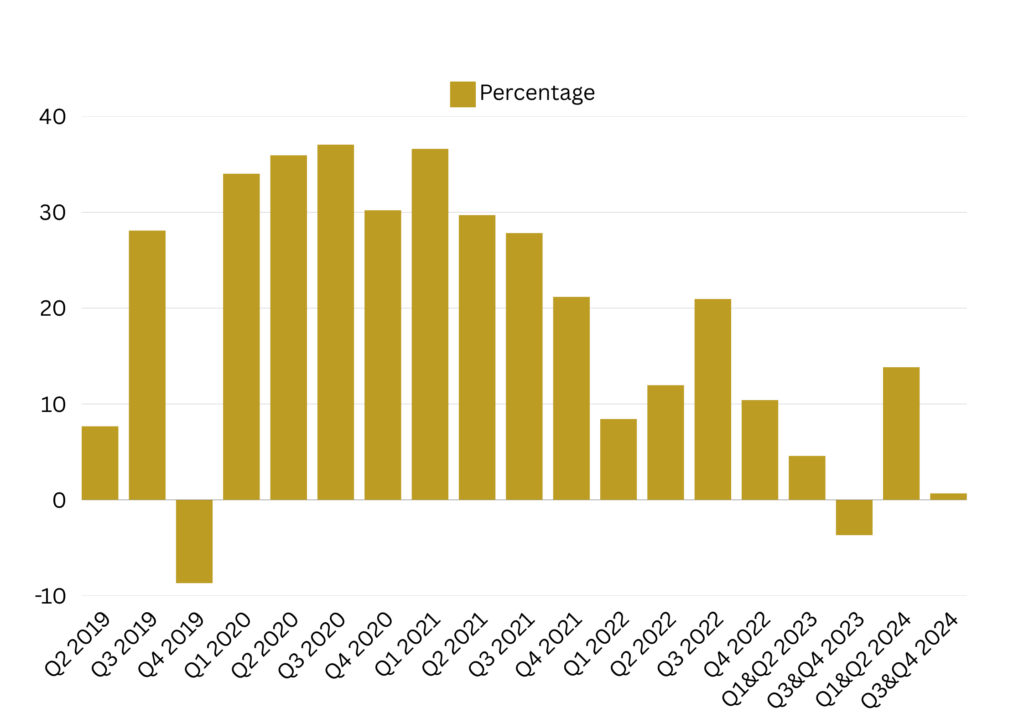

NEWFLASH QUARTERLY ANALYTICS

NEWFLASH MONTHLY RETURNS%

Your Profit our Priority

BERKELEY

Berkeley is a multi-strategy algorithmic foreign exchange trading portfolio that uses gold and G10 currencies. Berkeley’s core is a diversified trading method that aims to provide the best performance and the least amount of downside over an extended period of time. Based on a range of macroeconomic data and economic trends, it adopts short-term directional perspectives. The algorithms include mean reversion, breakout, and momentum methods.

Berkeley is a medium-term low frequency trading portfolio that focuses mostly on currency volatility breakout techniques. Depending on price channel, pivot, and price action, it executes many techniques at once with various configurations. When the market is oversold, the algorithm buys, and vice versa, taking advantage of inflated market swings. Take-profit, stop-loss, time-stop, trailing-stop, and other tools are used by the trading system to manage open positions.

Performance Fee: 40%

Available on: EU Region only

BERKELEY PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

BERKELEY QUARTERLY ANALYTICS

BERKELEY MONTHLY RETURNS%

Your Profit our Priority

ELITIST

A committed team from Paris, France, created the expert advisor portfolio Elitist, which is based on a short-term trading approach. When the American trading day ends, this sophisticated algorithm trader engages in night scalping. To safeguard investors’ deposits, every transaction contains a take-profit and stop-loss. G10 currency pairings are Elitist’s primary emphasis, and the technology offers flexible money management.

Performance Fee: 40%

Available on: EU Region only

ELITIST PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

ELITIST QUARTERLY ANALYTICS

ELITIST MONTHLY RETURNS%

Your Profit our Priority

VICTORIOUS

An Australian proprietary trader with more than 15 years of trading expertise oversees Victorious, a completely automated scalping expert adviser. The expert trading method uses a highly developed trading algorithm that has been extensively tested over many years to trade based on price movement without the need of trailing indicators. The breakout technique performs exceptionally well on tight spread ECN brokers and primarily targets the big pairings GBPUSD, EURUSD, and USDJPY.

Successful benefits include a rigorous money management system and a dynamic profit fixing algorithm. To preserve modest drawdown, a tight trailing stop order is being used. Because of the enormous trading volume, it makes use of a lot of leverage and takes advantage of the extremely narrow interbank spreads inside the G10.

Performance Fee: 35%

Available on: Australia, Canada

VICTORIOUS PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

VICTORIOUS QUARTERLY ANALYTICS

VICTORIOUS MONTHLY RETURNS%

Your Profit our Priority

SERENITY

An algorithmic trading portfolio technique called Serenity is run by a machine learning-savvy trading team from Ukraine. It focuses on G10 currency pairings and combines scalping strategies with medium-term positioning. Scalping is used to find short-term profit chances inside medium-term trends, which are identified using a combination of technical indicators and fundamental research. This two-pronged strategy seeks to optimize profits while efficiently controlling risk throughout a range of time periods.

The expert system is well-suited to exploit and propagate volatility. Based on data and analysis from the real-time foreign exchange market, this machine has been operating for four years. Since the algorithms trade a variety of tactics, the sets must be updated to reflect the shifting market. The staff is involved in system optimization in every situation.

Performance Fee: 25%

Available on: Africa, Rusia, Dubai

SERENITY PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

SERENITY QUARTERLY ANALYTICS

SERENITY MONTHLY RETURNS%

Your Profit our Priority

CLOUD TRADER

With very high long-term operating stability, Cloud Trader is a Chinese algorithm trader that operates a real multi-strategy complimentary coupling system on several currencies. The main tactic of Cloud Trader is a trend-following trading system that employs a volatility breakout technique for entry and is built for exceptional performance. Both trend reversals and significant price fluctuations will be pursued by it. The goal of this approach is to identify broader market trends as early as feasible. Averaging out multi-currency pairs is crucial for limiting drawdowns and generating additional gains.

The China proprietary trader has developed a sophisticated Risk/Reward management system. Trades are open on strong price breakouts and can last for several days to weeks. The trader also integrated a profitable day trading strategy focuses on major pairs into the system.

Performance Fee: 25%

Available on: China

CLOUD TRADING PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

CLOUD TRADING QUARTERLY ANALYTICS

CLOUD TRADING MONTHLY RETURNS%

let money works for you

GLOBAL VISION

Global Vision is an advanced trading system that can adapt to any market phases by integrating multiple momentum and mean-reversion methods. established by a highly skilled trading crew from Central Europe with a focus on major and minor FX pairings. In order to identify patterns of trend continuance and reversal, momentum techniques track many periods. To maximize the risk-reward ratio, strategies like trailing/time stop and objectives dependent on market volatility are employed. Before the weekend, all orders are closed. If a reversal is likely, the mean reversion techniques open trades during the low volatility Tokyo trading session.

All strategies are independent and risk a small portion of the capital. Each strategy was back tested with 99.9% modelling quality and passed a forward test of at least 4 years on a live account. The system is regularly fine tuned to adapt to the current market.

Performance Fee: 35%

Available on: China, EU Region

GLOBAL VISION PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

GLOBAL VISION QUARTERLY ANALYTICS

GLOBAL VISION MONTHLY RETURNS%

start your money Machine

FORTUNA

A Chinese FX specialist created the algorithm portfolio Fortuna, which is based on the low frequency scalping approach. This automated trading strategy applies mean reversion concepts to cross-currency pairings, such as EURSGD, GBPCHF, and GBPCAD. In essence, mean reversion is the return of volatility to its long-term average. Each order has a stop-loss, and the algorithms are based on a volatility adaptive mechanism. Positions can be ended regardless of profit or loss thanks to an integrated adaptive volatility soft loss processing algorithm.

Performance Fee: 40%

Available on: CHINA

FORTUNA PERFORMANCE CHART

Return is gross return on balance and before performance fee. Open positions that carry unrealized profit/loss are not taken into account to calculate gross return. Past performance results are not necessarily indicative of future results

FORTUNA QUARTERLY ANALYTICS

FORTUNA MONTHLY RETURNS%

start your money Machine

SOLID EDGE

The developers behind Semi-HFT are unveiling Version 2, now rebranded as SolidEdge, bringing enhanced features and performance. Created by a team of experienced record traders from Eastern Europe, Semi-HFT is an advanced scalping trading system that leverages High Frequency Trading (HFT) technology. This fully automated system employs a mean reversion strategy across various foreign exchange pairs, relying on the principle that prices tend to return to their average over time. The strategy is specifically designed to trade during the quieter Asian market hours, ensuring optimal performance.

Semi-HFT also features a sophisticated stop-loss management system, combining dynamic and hard stop-loss methods to enhance the stability and reliability of the algorithm. Each trade is safeguarded with a stop-loss order, and the system operates under the oversight of professional fund managers.

Performance Fee: 40%

Available on: Asia, Australia

Data statistic will be release by Q3

Want to find out more about SolidEdge? Click on the register button below or contact us directly on sales@pammultra.com

How PAMM Ultra works

- FINANCE

- quality

- Trust

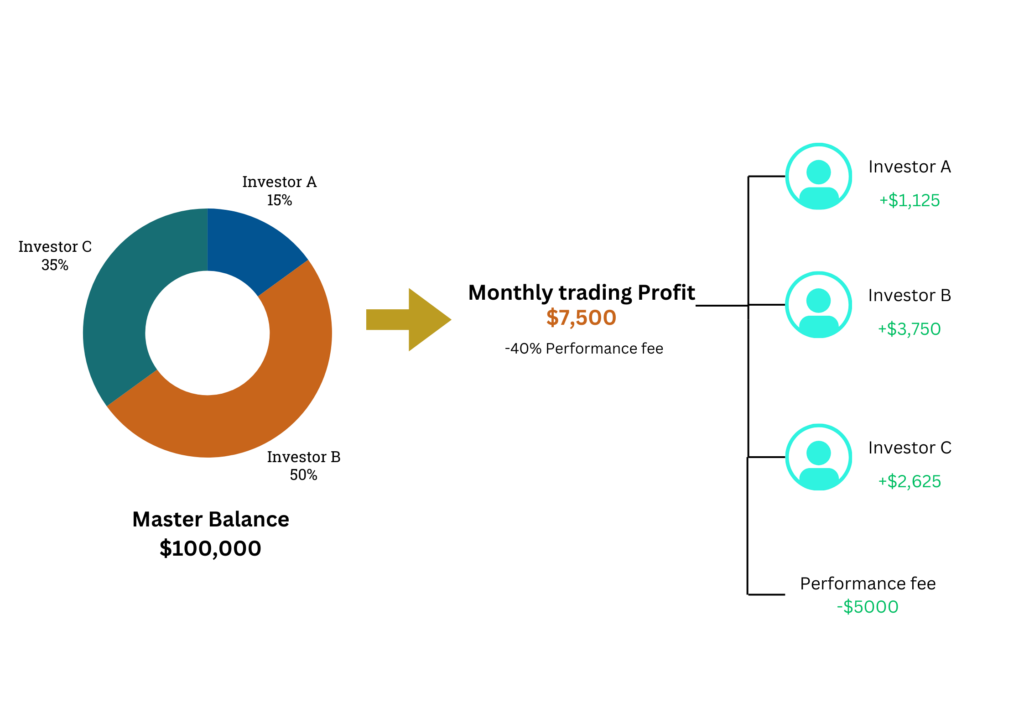

If a PAMM / MAM account has 3 clients with various deposits as follow, which in total the amount is US$ 100,000.

Investor A – US$ 15,000 (15%)

Investor B – US$ 50,000 (50%)

Investor C – US$ 35,000 (35%)

If the portfolio managers generate profits of US$ 12,500 in the PAMM / MAM account, the profits will be divided among the investors according to the percentage above. PAMM Ultra portfolio managers charge performance fee of 40% of the total profits of US$ 12,500. The portfolio managers shall be entitled for US$ 5,000 and the balance of US$ 7,500 shall be divided among the investors.

Investor A – US$ 1,125 profit (15% of US$ 7,500)

Investor B – US$ 3,750 profit (50% ofUS$ 7,500)

Investor C – US$ 2,625 profit (35% ofUS$ 7,500)

The following chart shows the profit and loss allocated proportionally to the participating investors and performance fee to portfolio managers in the PAMM / MAM account.

Why invest in Managed Forex Accounts with PAMM ULTRA ?

- A professional trader (money manager) oversees the invested funds of clients without having access to the capital itself.

- No technical expertise or experience of currency trading is required of investors.

- Investor can choose among leading investment strategies

- Only at the conclusion of a profitable month, subject to a high watermark basis, is a performance fee assessed.

- Low minimum investment.

- Low minimumTotal control over trading account. Investor can deposit, withdraw or cancel management service at any time. investment.

- Clients have information on the balance of their accounts 24 hours a day, 7 days a week.